How to Compute 13th Month Pay | 13th Month Pay Law in the PH

Employees in the Philippines look forward to spending the holidays with family and friends, feasting and gift-giving, during the Christmas season. In addition, everyone is looking forward to receiving their 13th-month pay and, for some, additional bonuses! Job opportunities in the Philippines can affect the amount of 13th-month pay an employee receives. Familiarize yourself with the essential 13th-month salary facts, Before estimating how much 13th-month pay you’ll receive this coming December.

Facts About 13th-Month Salary

It’s mandated by the law.

All rank-and-file employees in the Philippines, including those in the BPO Philippines industry, are entitled to 13th-month pay regardless of their status or the amount of their basic salary as long as they have worked for their respective companies for a minimum of one month. It is required by law, according to Presidential Decree No. 851, that employers must follow the law and pay their employees for the 13th month.

When should I receive my 13th Month’s Pay?

Employers who are currently doing job hiring in the Philippines and have rank-and-file employees must provide 13th-month pay no later than December 24th, according to the rules implementing the 13th-month pay law. Employers who are generous are free to provide this benefit to their employees as early as November.

Are Christmas bonuses different from 13th Month Pay?

A Christmas bonus is a different type of payout. Employers can choose to give their employees Christmas bonuses. These bonuses are usually derived from additional payouts from company-wide performance revenues. Aside from cash, Christmas bonuses can take the form of Christmas baskets, gift certificates, or anything else of value.

Who is exempted from the 13th-month pay rules?

PD No. 851 protects many employees in the public, private, and government sectors. Employees working in the following situations, however, are exempt from this decree:

-

Employees working for the government except for corporations operating as private subsidiaries of the government.

-

Employees receive mid-year bonuses, Christmas bonuses, cash bonuses, or payments equal to or more than 1/12 of the basic salary excluding cash and stock dividends, cost of living allowances, other regular allowances, and non-monetary benefits.

-

Employers are mandated to pay the difference should employees receiving bonuses take home less than 1/12 of their basic salary.

-

Household employees and professionals in personal services.

-

Employees are paid by commissions and boundary work and professionals receive fixed payments for specific projects and tasks.

Parental leave is not factored into the 13th-month pay calculation.

The number of days parents spent on maternity and paternity leave will not be factored into their 13th-month pay. According to the law, the inclusion of the 13th-month salary is equal to one-twelfth of an employee’s monthly work. Even if parents received claims from other government agencies, they will not be included in the final calculation of mandatory pay.

13th-month pays are exempt from taxation, except for…

Employees earning less than Php 82,000 gross benefit will not be taxed; employees earning more than Php 82,000 will have their 13th-month salary taxed.

Employees who have been terminated or resigned from their previous employers are still eligible for 13th-month pay.

The Philippine Labor Code promotes employee well-being in a variety of ways. It’s a law that shields employees from abusive bosses.

Employees who were terminated or resigned before the 13th-month payment are still eligible. The benefit calculation remains the same.

Tax deficits do exist!

The term “tax refund” is more widely used than “tax deficit.” A tax refund is a rebate given to the taxpayer if he paid more than the required amount for his tax, whereas a tax deficit is the inverse. It indicates that the taxpayer paid less than the required tax amount. When a taxpayer tallies his tax payables and the amount is less than the required amount, he is obligated to pay the difference from his first or second paycheck the following month.

Conclusion

The 13th-month payment is a great way to supplement your income and save for the holidays. Always be on time and present at work to maximize your most anticipated payment of the year. Using your leave credits when you are sick, on vacation, or have a home emergency is a great way to reduce your absences. It’s also important to pay attention to specific deductions on your paystubs, such as withholding tax, in order to predict any tax deficits the following year.

How to Compute Your 13th-Month Pay

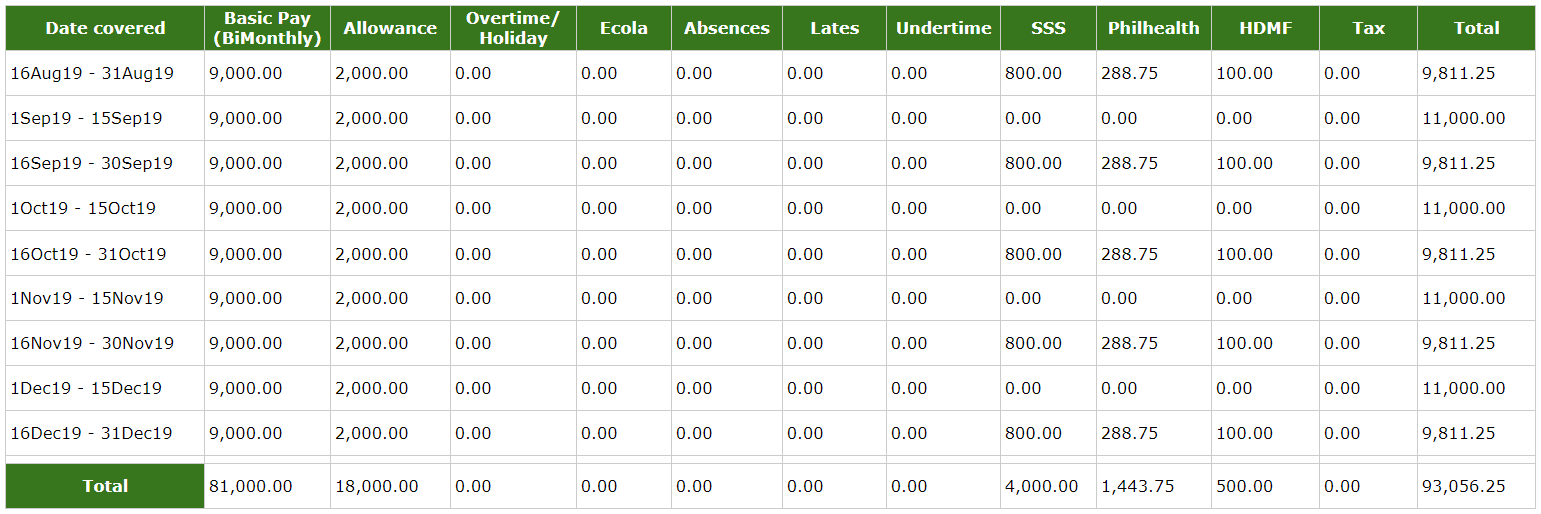

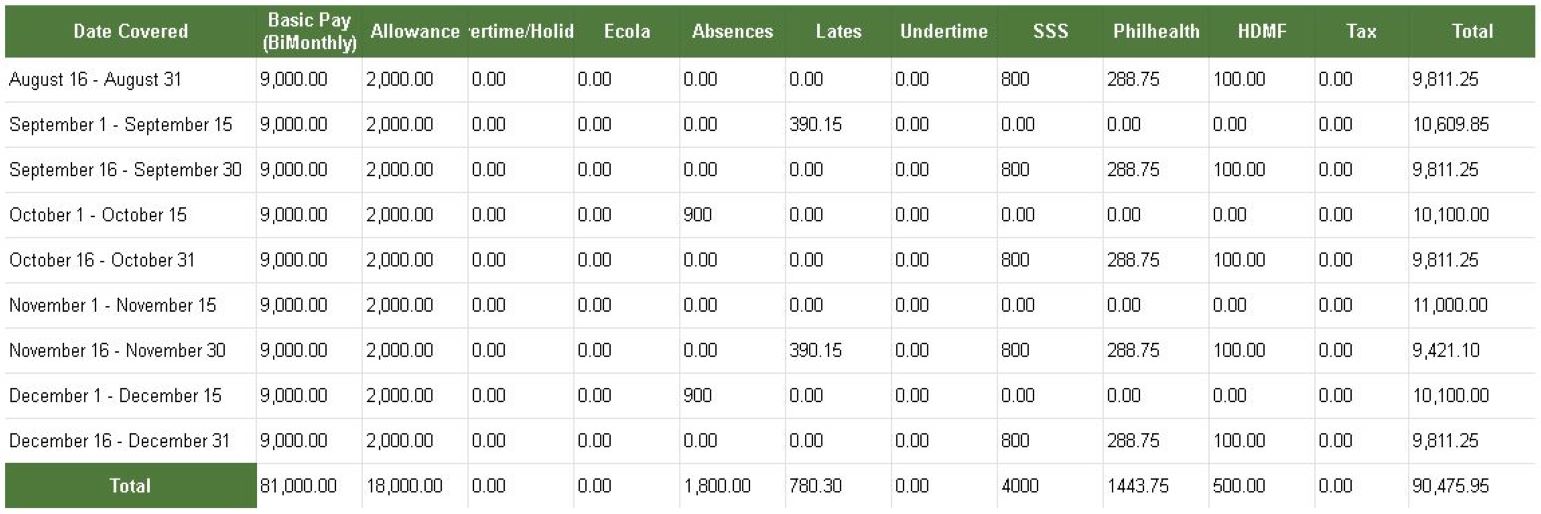

It’s easy to overestimate your 13th-month pay, especially if you only know the basic formula: monthly basic salary multiplied by months worked in the company over a 12-month period. As illustrated in the table below:

Monthly basic salary × months rendered

12 months

Nonetheless, there’s a bit more to it than just that. Gathering all of your payslips for a more accurate computation is the best way to get as close to estimating your 13th-month salary as possible.

FIRST, make a spreadsheet and enter the correct data into the appropriate category. Include everything, including your deductions for lateness, absences, and undertime.

SECOND, add everything up to easily calculate your estimated 13th-month pay. It is important to note that the 13th-month pay is calculated as the number of months worked by the employee, which means that additional holiday pay and premiums are not included in the calculation.

The calculation involves subtracting the total salary deductions, which may include absences, lates, and undertime, from the total basic salary earned over a period of 12 months.

Total of basic salary – Total of salary deductions

12

That’s all there is to it! When calculating your 13th-month pay, this is the best estimate you can get. If there are any discrepancies, contact your HR managers or leaders to get a more detailed explanation of how your 13th-month payment was calculated in your company.

Additional Information About 13th-Month Salary

When an employer fails to pay 13th-month wages

Some employers believe they can avoid providing 13th-month benefits to their employees, but they cannot. Employers are required by law to provide employees with 13th-month benefits unless they already provide them with Christmas bonuses equal to their 13th-month pay or higher.

Employers who fail to provide 13th-month benefits to their employees may face administrative action. Employees are encouraged to report such employers and receive their mandatory pay by filing charges at the nearest DOLE office.

Can employers avoid paying the 13th month?

If an employer qualifies for an exemption, they may be exempt from paying 13th-month wages. If an employer is eligible for an exemption, there are several factors to consider. There are certain circumstances that may exempt an employee from receiving the 13th-month pay, such as (1) being compensated on a commission, boundary, or task-based basis, and (2) the employer providing their employees with 13 months’ worth of pay or more in a calendar year or its equivalent. Whether or not to defer the 13th-month pay during a crisis has also been a subject of debate in the country.

The Department of Labor and Employment (DOLE) has determined that “distressed” small and medium-sized enterprises (SMEs) that have been affected by a global crisis or have incurred significant losses may be exempt from providing 13th-month pay to their employees. However, after days of debate, Labor Secretary Silvestre Bello III has stated unequivocally that all employers must release their employees’ 13th-month pay on or before December 24th, as required by law.

NEW! The 13th month of the pandemic.

Last year (2020), the government advised employers to give their employees their respective 13-month pay despite the pandemic and the financial loss they have suffered as a result (source). As of this writing, the Department of Labor and Employment has made no announcement.

Employees can receive 13th-month pay in two installments, twice a year.

To meet the growing demand for parents, Presidential Decree No. 851 allows companies to pay employees half of their 13th-month salary in the first half of the year and the rest in the second half, if the employee consents or requests it.

A 14th-month pay bill has also been introduced in the Senate.

Senate President Vicente “Tito” Sotto introduced legislation in the Senate requiring all employers in the public, private, and government sectors to provide 14th-month payments to all rank-and-file employees in May of each year in anticipation of school enrollment for employees with dependents.

Because the bill has yet to be enacted, the 14th-month payment remains a distant dream for all employees looking for additional sources of income. The bill has been in the works since July 2016, and it must be approved by both the House of Representatives and the Senate before it can become law.